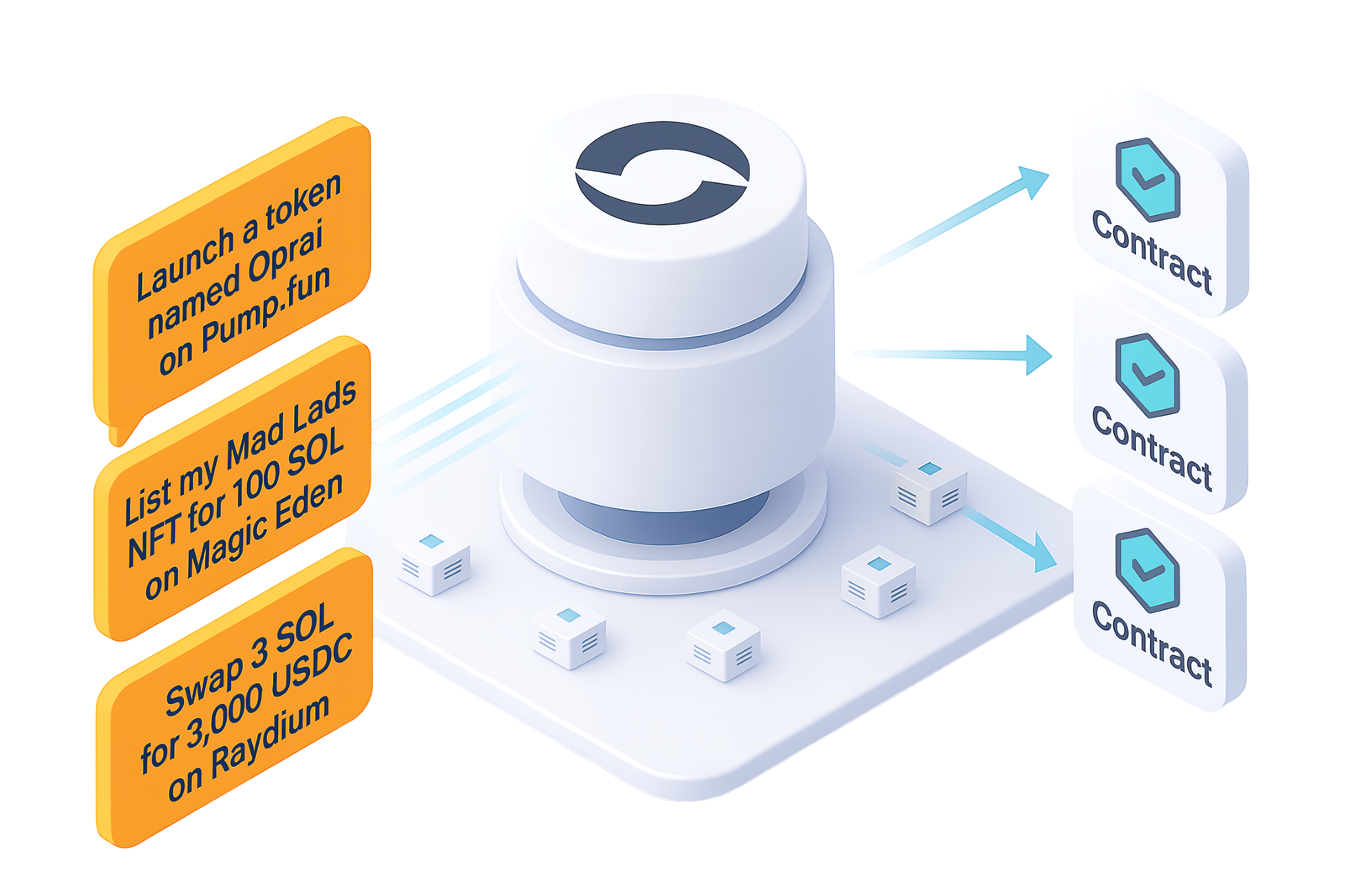

Turning language intoon-chain actions

Connect your wallet once and command Solana's entire DeFi ecosystem through natural language. From token launches to complex yield strategies—execute institutional-grade operations with conversational simplicity.

Run Solana, powered by language.

Oprai is the conversational layer for Solana—connect once to brief, price, and execute strategies without dashboards or manual sequencing.

Oprai sits between your prompt and compliant execution—translating treasury rules, policy guardrails, and venue routing into a single signature-ready runbook.

- Connect your wallet once; Oprai interprets commands and executes across all Solana protocols.

- Conversational intents become routed strategies across DEX, lending, perps, and NFT markets.

- Instant intelligence on new launches with holder health, bundle flow, and volatility signals.

One agent for the entire Solana DeFi stack.

Execute complex DeFi strategies across every major Solana protocol through a single conversational interface.

NFT Trading Module

Curated drops, allowlist automation, floor sweeps, and exit ladders executed with policy guardrails.

DEX Aggregation Module

Route intents across AMM, RFQ, and CLMM venues with live liquidity sensing and slippage locks.

Token Launch Module

Ship SPL launches end-to-end—tokenomics drafts, pool deployment, and launch surface orchestration.

Perpetual Trading Module

Execute hedges, basis plays, and kill-switches with automated funding and risk thresholds.

Lending & Borrowing Module

Loop collateral, farm incentives, and auto-rebalance health factors across Solana money markets.

Bridge Module

Synchronize cross-chain liquidity, monitor bridge risk signals, and approve vault transfers with live attestations.

Liquid Staking Module

Rotate stake across validators, harvest rewards, and redeploy yield-bearing assets into Solana-native strategies.

DeFi Strategy Engine

Compose multi-step automations, simulate guardrails, and capture telemetry for policy sign-off.

Institutional-Grade AI Execution Engine for Solana

Transform natural language into battle-tested DeFi strategies. Every transaction is simulated, optimized, and validated through our 4-layer security framework before execution.

Prompt → Execution Brief

Intent becomes a MEV-protected execution plan.

- Natural language parsed into Solana instructions

- Multi-protocol routing optimization

- Gas estimation and priority fee calculation

Simulate Before Deploy

Every path backtested against live mempool.

- Slippage simulation across all DEX routes

- Impermanent loss calculations

- Smart contract vulnerability scanning

Confirm With Context

Transparent pricing with institutional analytics.

- Real-time price impact analysis

- MEV extraction prevention

- Cross-venue arbitrage detection

Monitor And Review

Real-time P&L with on-chain attribution.

- Transaction success rate tracking

- Profit/loss attribution by strategy

- Automated tax reporting exports

Intent

- Launch token on Pump.fun

- Add $50k liquidity on Raydium

- Lock LP for 30 days

- Enable trading with anti-rug mechanics

Policies

- Max slippage0.5%

- MEV protectionEnabled

- Multi-sig threshold$10,000

- Audit requirementCertiK verified only

Simulation

- Expected APR127.3%

- Gas cost0.0023 SOL

- Success probability98.7%

- Risk scoreMedium (IL exposure)

Execution

- RouteJito Bundle #4829184

- Saved$127 vs direct execution

- Performance+2.3% vs benchmark

- StatusMulti-sig pending (2/3)